In this article, I will discuss the Best Credit Card To Earn Velocity Points with a strong emphasis on the rewards and travel benefits.

Even if one is not a regular traveller and wishes to save up points on day-to-day purchases, I will mention the best ways in which one may earn and redeem Velocity Points.

Key Point & Best Credit Card To Earn Velocity Points List

| Credit Card | Key Feature |

|---|---|

| Citi Premier Credit Card | Earn points on everyday purchases and access to exclusive dining and travel offers. |

| American Express® Platinum Business Card | Premium business rewards, travel perks, and concierge service for businesses. |

| American Express Velocity Business | Earn Velocity Points on business expenses, with added travel benefits. |

| ANZ Rewards Platinum | Access to rewards points on everyday spending with bonus offers and travel benefits. |

| American Express Platinum Card | Exclusive lounge access, high points earning rate, and premium travel benefits. |

| St.George Amplify Rewards Signature | Earn rewards points on purchases with bonus categories and travel benefits. |

| Westpac Altitude Rewards Black | Earn Altitude Points for every dollar spent with additional bonus offers. |

| American Express Explorer Credit Card | 2 Membership Rewards points per dollar spent, plus extensive travel insurance. |

8 Best Credit Card To Earn Velocity Points

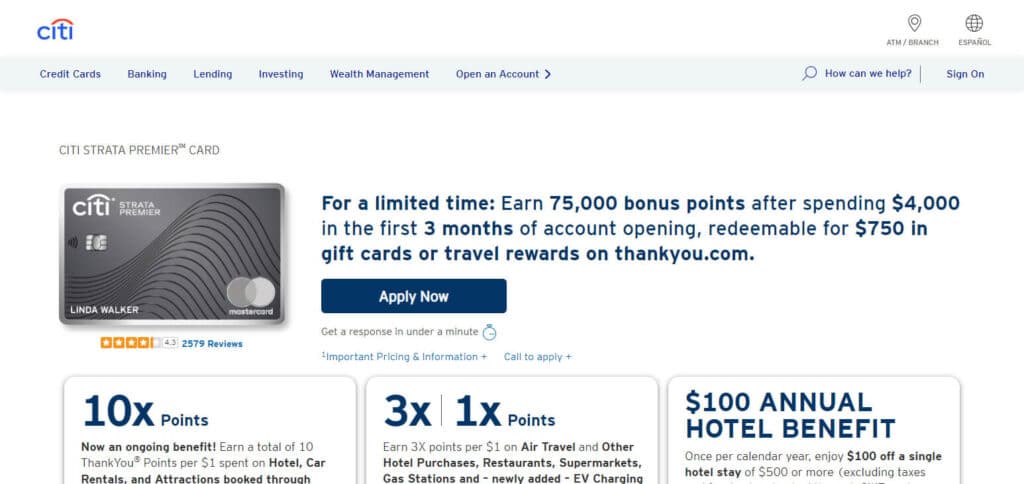

1. Citi Premier Credit Card

The Citi Premier Credit Card is a great way to build your Velocity Points thanks to the higher rewards rates on dining, entertainment, and travel.

Cardholders can earn points in the Citi ThankYou program, which can be converted into points in the Velocity Frequent Flyer program.

Expanding on bonus points on select categories and additional travel offers makes this credit card an easy and great way to earn points, making it suitable for those who travel often and love the additional extras for a range of spending categories.

Citi Premier Credit Card Features

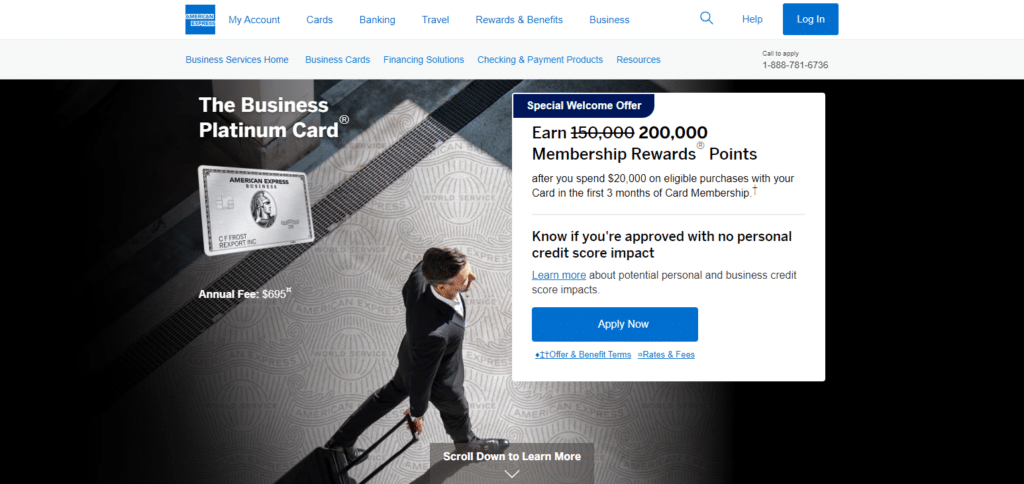

2. American Express® Platinum Business Card

American Express has devised this card specifically for business owners who want to make the most of their Velocity Points.

It has great appreciation rewards on business-related travel, office, and advertising expenses. Points accumulated on this card can be converted into Velocity Frequent Flyer points, allowing for more options to earn miles for business trips.

The card has more bells and whistles for business travellers, such as airport lounge access, concierge assistance and high-tier customer support.

American Express® Platinum Business Card Features

3. American Express Velocity Business

The Velocity American Express business card is designed specifically for business owners who would like to use their everyday expenses to earn Velocity Points.

With this card every transaction that you do attracts Velocity Points as well as the option of directly transferring the points to your Velocity Frequent Flyer Account.

It has other features as well such as business traveling perks, preferrable tiers, best customer service and free cover which makes it a great option for companies who frequently travel and hope to gain points out of it.

American Express Velocity Business Features

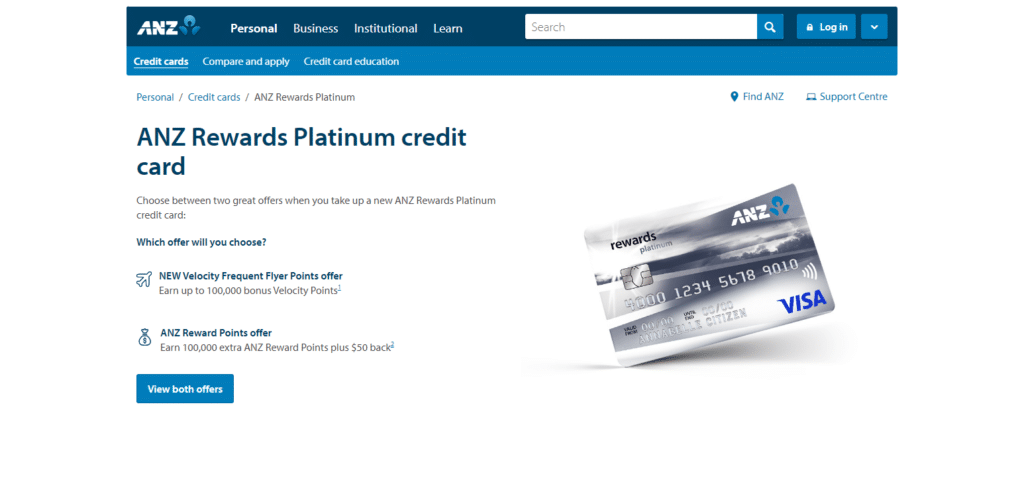

4. ANZ Rewards Platinum

The ANZ Rewards Platinum Credit Card significantly enhances the velocity points accumulation for its users.

Cardholders also earn ANZ Rewards points on their day-to-day expenses, which can cumulatively get converted into Velocity Frequent Flyer points.

The card also comes with additional offers, namely travel accident insurance, extra offers, and bonus point rewards on certain categories.

Also, the cardholders have limited annual fees and the flexibility to redeem points to pay for Velodrome points. Hence, it is a perfect card for all individuals wishing to earn Velocity Points from multiple avenues.

ANZ Rewards Platinum Features

5. American Express Platinum Card

The American Express Platinum Card happens to be one of the ideal cards for earning Velocity Points.

It offers two Membership Rewards points for every dollar spent, which can then be converted into the Velocity Frequent Flyer program at a 1:1 ratio.

Moreover, the card comes with numerous high-end features, including but not limited to complimentary access to premium airport lounges, global travel insurance, concierge services and invitations to various events.

This card would be appropriate for a person who is a frequent traveller since he or she can earn Velocity Points while enjoying the best privileges and services.

American Express Platinum Card Features

6. St.George Amplify Rewards Signature

The St.George Amplify Rewards Signature is a perfect credit card for those who like to earn Velocity Points but at the same time have the advantage of the Amplify Rewards program.

In addition, regular purchases made using the card would subsequently allow for the conversion of points into Velocity Frequent Flyer points.

Moreover, it also gives access to some travel benefits like additional rewards points on selected items, travel insurance and special deals for credit card owners.

Competitively priced with low annual fees and with a solid rewards program, it’s perfect for anyone wanting to grow their Velocity Points balance.

St.George Amplify Rewards Signature Features

7. Westpac Altitude Rewards Black

The Westpac Altitude Rewards Black credit card is great if you want to earn Velocity Points on simple purchases.

The card’s owners also earn Altitude Points on every purchase made, which can be turned into Velocity Points.

It also has travel insurance coverage, complimentary airport lounge access, and bonus points for selected categories.

This card is a great option if you are planning to travel as it has an earned rate for both daily and travel expenditures, which helps you qualify for Velocity Points fast and travel rewards at the same time.

Westpac Altitude Rewards Black Features

8. American Express Explorer Credit Card

When it comes to earning Velocity Points, the American Express Explorer Credit Card is among the great benefits, as it offers 2 Membership Rewards points per dollar spent, which can then be transferred to the Velocity Frequent Flyer program at a 1:1 ratio.

Furthermore, the card extends travel insurance, priority access to airport lounges and some exclusive travel packages.

This is a great card for those who want to earn Velocity Points, which are combined with premium travel offers and benefits.

American Express Explorer Credit Card Features

How To Choose Best Credit Card To Earn Velocity Points

These are the things to keep in mind when choosing the best credit card for the best velocity point earnings.

Points Earn Rate Go for cards that have a high earn rate on travel, dining, and other purchases, as some cards are better for a certain type of spending and earning more points.

Points Transfer Options Make sure to double-check whether or not the card allows you to transfer your earned points to the Velocity Frequent Flyer program, as many people would want to transform their points into miles.

Travel Perks Always look for cards that have additional perks, such as free travel insurance, travel offers, and airport lounge access, as these help during travel.

Fees: Always check the fees, interest rates, annual fees, etc. Always be on the lookout for options that are reasonable and profitable.

Additional Benefits Look for cards that provide purchase protection and concierge services, along with other benefits such as valuables, which would add more worth to the card.

Conclusion

To sum up, the optimal credit card to earn Velocity Points is dependent on your spending and lifestyle patterns.

For frequent travellers, the American Express Platinum Card or the American Express Velocity Business Card provides great perks along with high rewards.

For many, the ability to earn more points with bonus categories or flexibility is important, and if that is the case, considering the Citi Premier Credit Card or the Westpac Altitude Rewards Black card is great.

Ultimately, it makes sense to include the points in the earn rate, how many times you can transfer the points, and any other features of the card available for selection.

Leave a Reply