In this article, I will discuss the Best Stock Brokers To Earn Money.

Investing in stocks is an excellent way to grow one’s wealth, but a great stock broker has to be chosen to get good returns.

Low commissions, availability of various markets, and good trading software will help one’s investment grow significantly.

I will research various brokers, focusing on the best stocks and their investment techniques to help earn money.

Key Point & Best Stock Brokers To Earn Money List

| Platform | Key Point |

|---|---|

| Degiro | Low-cost European broker with access to global markets. |

| Zerodha | Leading Indian discount broker with a strong trading platform. |

| SoFi Invest | User-friendly investing app with commission-free trading and tools. |

| Merrill Edge | Full-service broker offering research, advice, and integrated banking. |

| Webull | Commission-free trading with advanced tools and mobile app. |

| Robinhood | Popular for commission-free trading and easy-to-use interface. |

| Interactive Brokers | Advanced trading tools and access to international markets. |

| E*TRADE | Comprehensive platform with strong research, education, and trading tools. |

| Fidelity | Offers extensive research, low fees, and retirement planning services. |

| Vanguard | Focused on long-term investments with low-cost index funds and ETFs. |

10 Best Stock Brokers To Earn Money In 2025

1. Degiro

Degiro is a European discount broker and offers trading services in many international markets at a reduced commission fee.

With competitive fees, it is an excellent option for those looking for cheaper investment alternatives.

The platform enables users to trade in various stocks, bonds, and Exchange Traded Funds (ETFs). Although it does offer a few premium research tools, it specializes in low commissions and a user-friendly interface, which would appeal to investors wishing to invest on a global scale while keeping costs as low as possible.

Degiro Features

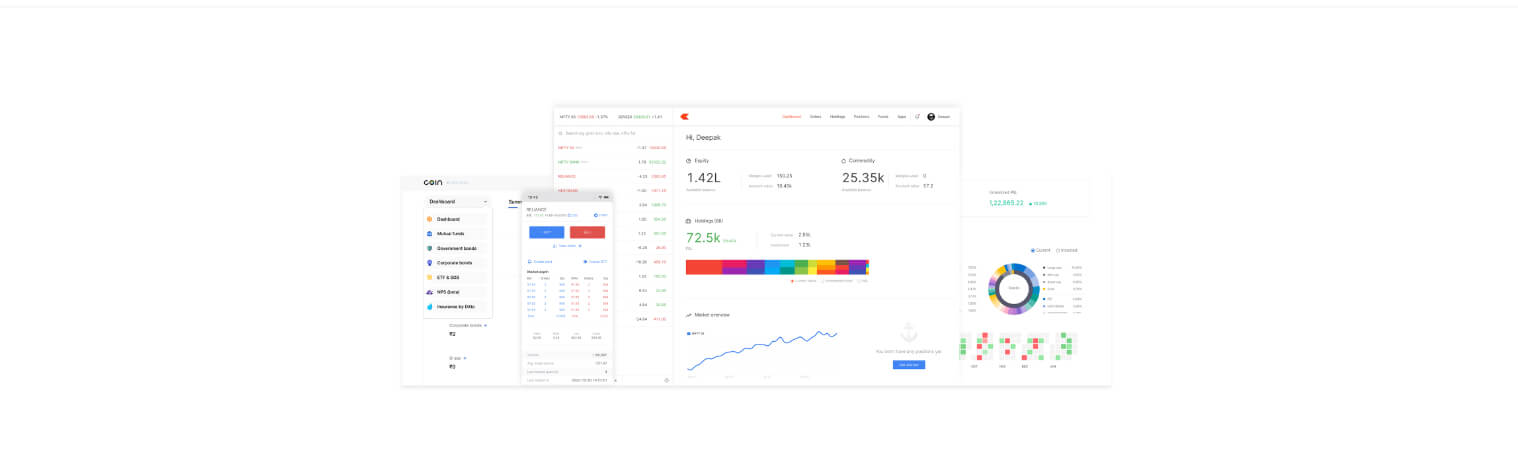

2. Zerodha

Zerodha is the best discount broker with no minimum deposit, and you don’t have to pay considerable amounts to trade.

The platform lets you access stocks, commodities, and derivatives with the help of a plain user interface.

Zerodha even has the Kite and Varsity trading tools, allowing beginner and veteran traders alike to have the resources necessary to work.

With low costs and an emphasis on supporting the traders, Zerodha is perfect for Indians looking into investing with minimal expenses.

Zerodha Features

3.SoFi Invest

Because SoFi Invest has such a simple platform, beginners are not put off, and experienced investors can trade without incurring a commission on trades, enjoying a nice user experience.

Users can invest in stocks, ETFs, and cryptocurrencies, along with automated investing for passive investing.

They can also help provide financial advice and educational materials, making SoFi an all-in-one place to help build wealth.

The simple interface and the low-cost structure make SoFi Invest a great choice for anyone looking to generate income by creating diverse investment portfolios.

SoFi Invest Features

4. Merrill Edge

Merrill Edge is a subsidiary of Bank of America.

The investment platform is powerful and emphasizes its research, advisory, and banking services.

The service allows investing in various instruments such as stocks, bonds, ETFs, and mutual funds. Merrill Edge’s research tools and educational materials meet the needs of both beginners and advanced traders so that everyone interested is comprehensively supported.

The long term investment regime is made even easier by accounts with Bank of America.

Merrill Edge Features

5. Webull

Webull is a commission-free trading platform unique because of its complex tools and charting features.

It allows stocks, ETFs, and options to be traded with extended hours for convenience.

Its sophisticated analytics, news, and technical indicators are more suited to active traders, while the platform is simple enough for novice traders.

Webull also does not charge any management fees or offer any educational materials, which makes it a good option for people who want to make informed and well-planned trades in the stock market to make money.

Webull Features

6. Robinhood

Robinhood has changed how investments are done by allowing people to trade stocks, ETFs and options without paying a commission fee.

Robinhood app offers ultimate convenience making it suitable for even the most novice investors.

The app offers free trades and fractional shares alongside automated cash management systems.

That said, it does not have a wealth of research capabilities on other broker platforms.

These features make Robinhood even more appealing as they mainly target people who want quick and easy trades and further welcome new investors.

Robinhood Features

7. Interactive Brokers

Interactive Brokers is globally recognized as a highly sophisticated broker with an advanced trading toolkit and low-cost structure.

It allows trading in stocks, options, futures, and forex and is suitable for advanced-level traders.

The platform has comprehensive research, educational materials, and trading algorithms.

Although its fees might be higher for starter-level traders, Interactive Brokers is perhaps one of the most recommended platforms for people, severe ones, wanting to make money through advanced strategies and broader market scope.

Interactive Brokers Features

8.ETRADE

ETRADE is a full-service brokerage allowing trading of stocks, options, and ETFs. It has two trading platforms, ETRADE Web and Power ETRADE, designed for novice and experienced traders accompanied by graduation tools and learning materials.

ETRADE is the best right for retirement and managed portfolio service users as the broker offers professional options to long-term investors.

Fees are low, and the research is excellent – the best ETRADE can offer for making money through diversified investment approaches and strategies.

E*TRADE Features

9. Fidelity

Fidelity, as a company, takes pride in its low-cost investment, its fullness in research tools, as well to specialize incredibly in retirement planning.

This allows customers to purchase stock, ETFs, and mutual funds without commission on all online trading with U.S. stocks and ETFs. Because Fidelity also has excellent educational support, it is helpful for people with an investment mindset who wish to grow and retire through planning tools over a long period.

The lack of commission is another very useful characteristic of this platform. Plus, the customer service is very pleasant, and the investment and retirement planning is all carefully handled, which is very good for a person who wants to be able to make money over some time.

Fidelity Features

10. Vanguard

Vanguard is among the best companies offering an affordable investment, primarily through index funds and ETFs.

For those who have a keen interest in passive investing strategies, Vanguard is a good option as it has the potential to grow over the long term.

Vanguard has plenty of mutual funds and ETFs available for investors and has a low-fee structure to increase the profits of those investments.

For people who want a stable return as well as overall growth, Vanguard is a great option as it focuses on holding and buying securities along with providing more than enough research capabilities.

Vanguard Features

Why Choose the Best Stock Brokers To Earn Money

Low Trading Commissions: Most stock brokers have low or no commission charges. As a result, more and more of your money is utilized for the investment rather than being spent on trading expenses, which automatically elevates your chances of ‘profit’ or more significant return investment.

Different Investment Opportunities: You can invest in more markets other than your own even if the other country’s economy is unstable, as the best brokers offer stocks, exchange-traded funds (ETFs), and options and reach markets all over the world, giving you great diversity among your investment portfolio.

Cutting Edge Tools: Noteworthy stock brokers provide trading platforms with all necessary research tools as well as educational materials on stock trading, which, if taken into account, can increase the chances of succeeding in stock trading to a higher percentage.

Intuitive Navigation: Most top brokers emphasize how the interface of their platforms looks so much that even the most novice trader can have lots of fun trading in the stock market.

Responsive Service: The success of trading largely hinges on the broker. A competent broker has excellent customer service so that the customer can get assistance anytime there’s an issue.

Stable and Secure: The intermediaries who have been in the stock market for a long time can give protection and security to your details and also funds thus giving you trust and confidence to trade.

Variety of Investment Vehicles: You can also mix your investments as the percentage of stocks, bonds, ETFs, mutual funds, and even cryptocurrencies will all depend on the tastes and preferences of the top brokers.

Educational Resources: The leading brokerages create webinars and appraisals, allowing users to learn and comprehend the prevailing market trends and investment approaches.

Automation and Smart Features: In addition, many brokers launch automated investment tools with likened features, which include robo-advisors that handle your portfolio, thereby increasing your investment without financial management on your part.

Retirement Planning: Usually, advanced brokers have older age-specific accounts like IRAs, which make you target retirement planning while your investment expands with time.

Conclusion

In summary, selecting the best stock brokers to make money means considering low commissions, access to a diversified pool of investments, and various tools and resources.

A credible stock broker features ease of use of the platform, comprehensive support service, and safety in trading.

By choosing a stockbroker that suits your investment objective, investing in different environments can enhance your wealth creation prospects.

Choosing a broker is the right timing to enhance your financial success.

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.